Third Party Liability

The deal with third party liability

Third party liability is a common name for the type of car insurance you can get to make sure that you’re not on the hook for third party costs in the event of an accident. If you break it down, ‘liability’ means ‘responsibility’, so if you’re liable then you’re officially and legally responsible. ‘Third party’ refers to the other person involved in the situation, like if you drive into someone else’s car then that person is the third party.

When people talk about car insurance, they generally want to convince you that comprehensive is the best option. And there’s merit to that argument. But that’s not what we want to talk about. We want to chat about third party costs and how this insurance could be the answer for you.

Third party costs

The reality is that accidents do happen. So, if you get into a car accident with another person, and it’s your fault, then you’ll be liable for the cost of repairing their car. These expenses could end up running into the tens of thousands. And that’s on top of whatever you need to deal with when it comes to fixing your own car.

Think about it…

Imagine that you drive what you consider to be a beautiful car. Beautiful because you own it, it’s yours, you look after it, and have we mentioned that it’s yours? Oh we did? Now imagine that you drive into the back of the latest Toyota Fortuner.

Take a second to consider just how much it would cost to repair even the most minor of scratches, let alone structural damage to the bumper of this kind of car. You’re possibly looking at R70,000 (maybe even more) because cars aren’t what they used to be and parts are increasingly more expensive. Anything that needs to be replaced needs to be ordered, there are labour costs involved, and even a spot of respraying to make sure it all matches up again.

It’s ridiculous how much it can cost to repair even the smallest of issues with cars nowadays, not to mention something more serious.

Third party liability saves the day

What this type of car insurance does is make sure that you’re not personally going to have to pay for any damage that you cause to someone else’s car. Given the costs involved, it’s completely worth it to take out third party liability cover.

How to get this cover

Comprehensive car insurance typically includes cover for third party costs, but if you can’t afford this option and your car is paid off and less valuable, then there’s a way to protect yourself from third party liability. Most (if not all) insurers also offer ‘third party, fire and theft car insurance’ and ‘third party only car insurance’. The first option covers third party costs and damage to your car by fire and the theft of your car. It costs less than comprehensive cover but won’t cover damage to your car if you get into an accident. This isn’t bad at all, especially considering how affordable it is.

But the cheapest way to cover third party costs, however, is to take out third party only car insurance. What you need to know is that the person whose property is being covered is NOT you. It’s only the third party involved, where you’re liable for the damage. In this case, a little cover is still way better than none at all!

You might not think that you’re super adventurous, but the fact is that we all take risks every day. Even making toast or getting out of bed can be risky. There’s no telling when an accident can happen, or who, or how many people might be involved. So make sure to cover third party car liability and prevent any unnecessary financial trauma from ruining your future.Click here to get a commitment-free quote in just 2 minutes or you can call 0860 50 50 50 to get in touch.

We found the cheapest insurance in South Africa

We found the cheapest insurance in South Africa

Everyone is on about finding the absolute cheapest insurance around… But this can often be a bit more difficult than we think because so much goes into creating a person’s monthly premium. Your age, where you live, how long you’ve been driving for, how many accidents you’ve had, how often you go out with the valuables you want to cover, etc. There are just so many details that help an insurance company calculate an accurate premium to insure your possessions. Of course, we can’t avoid the fact that some (not all) companies still want their pound of flesh, so there’s that, too.

How do you find the cheapest insurance around, then? Well, the obvious answer is to compare quotes and then choose based on the lowest price for the best value. And that’s the best advice you can ever receive. But for right now, before you head out on the hunt, we can point you in the direction of the actual cheapest insurance we’ve ever seen: R1 insurance.

That’s right. R1 insurance. You know how the oldies are always moaning about how ‘back in the day’, you could go to the movies for 17c, buy a coke for 5c, or pay a R15 deposit on a car? Well, this should make them pretty happy. And you, naturally, because everyone wants to pay the cheapest price.

What is R1 insurance?

You’re probably thinking, what’s the catch? There doesn’t seem to be a ‘catch’ so to speak, because this is an add-on product. This means that you take out the bigger insurance policy and add cover for just R1 per month. After that, it’s pretty straightforward.

The insurer in question is King Price, and the bigger insurance policy is comprehensive car insurance, and the R1 cover is for expensive valuables that you tend to take out with you, like your hearing aid, shiny new bicycle, or prized golf clubs.

Why does it exist?

These are some pretty specific items that are listed, however they’ve been intentionally selected from a range of items that you might not always think to insure. While it makes sense to consider cover for your laptop or cellphone, we don’t always remember to cover a hearing aid or bicycle. How often have you heard of your friend/uncle/sister/colleague’s bicycle being nicked?

It’s for that reason that the royal insurer decided to help people out by offering the cheapest possible cover for items that might not be obvious to insure, and yet are really costly and inconvenient to repair and replace.

Is their car insurance worth the R1 offer?

Look, this is totally your call. King Price’s comprehensive car insurance does come with all the bells and whistles, they’ve been in the business for a number of years and they’re reinsured by Munich RE (which is a big deal in the industry). Let’s not forget that they also decrease your comprehensive car insurance premium every month, in line with the depreciating value of your car.

When you weigh all these benefits up against how much your premium would cost if you were to insure your bicycle/golf clubs as a separate portable possessions policy, to your (non-decreasing) car insurance from another insurer, it makes sense to get a commitment-free quote, to see how you (and your budget) could benefit from the king’s royal touch.

The difference between mechanics and panel beaters

Car mechanics vs. panel beaters

The difference and why it matters

The process of having your car fixed is rarely (or should we say ‘never’) an enjoyable experience, even if you have car insurance to cover all the costs. At most, it can be satisfying to know your car’s getting some TLC and will be returned in tip-top shape. But that’s not quite the same as ‘enjoyable’. So long as it gets done, that’s about all we really care about (that, and when the car will be returned).

In fact, our concern doesn’t even extend so far as to know who’s dealing with the repairs. It could be a mechanic, a magician, or a panel beater. All we know is that the car’s in ‘for repairs’. To shed light on the subject, we’ve nailed down the differences between the 2 main car repair services and who you should see for what.

The deal with car mechanics

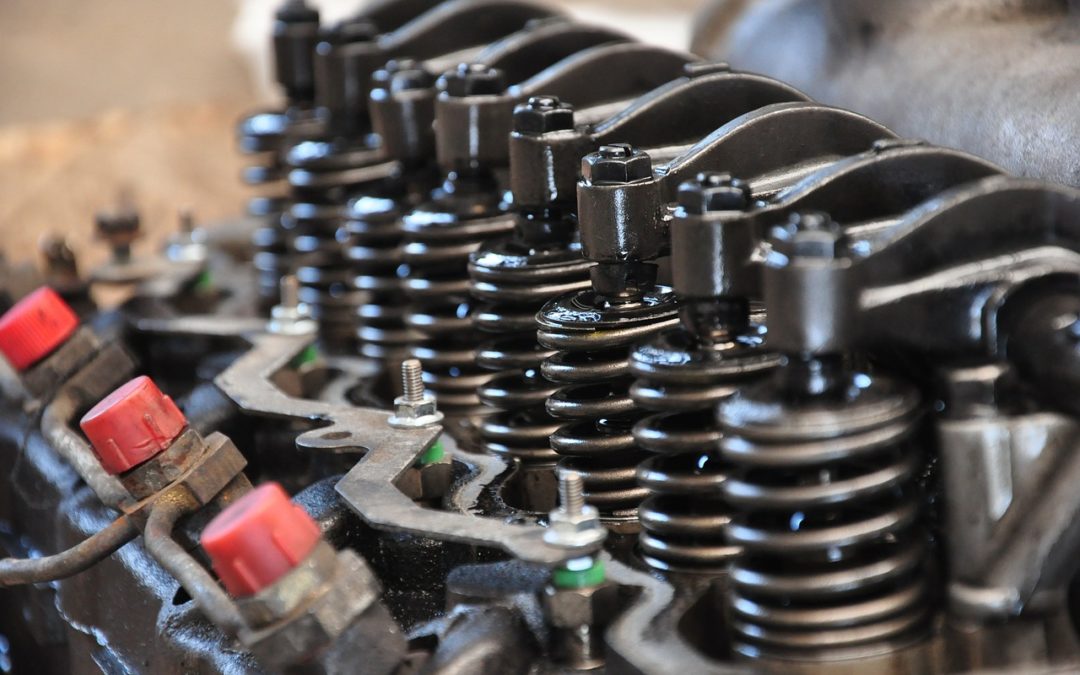

Many South Africans first think of visiting a mechanic if something goes wrong with their cars, especially after an accident. And they may be right. You see, car mechanics deal with the inner workings of your car, like not starting or making funny noises. These experts evaluate all your car’s mechanical systems and repair them using various tools and equipment.

Issues mechanics resolve:

- Engine noises and other strange sounds.

- The replacement of parts, such as the clutch or gearbox.

- Malfunctioning air systems.

- Misfiring spark plugs.

The list is seemingly endless, but only relevant to a car mechanic if the car has internal issues. If the car has body damage, then a panel beater is what you’ll need.

The deal with panel beaters

Panel beaters have nothing to do with the fixing of the inner workings of your car. These chaps are all about your car’s exterior and will take on the responsibility of repairing and realigning damaged and dented panels of your car’s bodywork. Much like mechanics, panel beaters have special equipment and processes, and rely on tools like files and grinding equipment, dollies, gouges, keys, chisels and clamps, and electrical equipment among others.

Issues panel beaters resolve:

- Removing or smoothing out bumps, dents, and general crinkles.

- Replacing damaged body parts and welding replacements in their place.

- Straightening bent frames.

- Aligning damaged frames, body sections, and unit bodies.

Panel beaters are also responsible for the final assembly and inspection for true fit, and will test your car to ensure proper connection and working components in electrical fittings, door handles, locks and lights. That’s as close as they get to being mechanics. If there are issues with these components that aren’t related to panel beating, they’ll refer you to a mechanic.

So, which service do you need?

There’s nothing worse for your car than getting the wrong repair service to take responsibility for the repairs. A panel beater shouldn’t fix your fan belt and a mechanic shouldn’t realign your bumper. It’s absolutely not a case of letting just anyone screw and bolt together parts with any old tool. Not only can it lead to more issues down the road (literally), but it could endanger your life.

The best way to think of it is this way:

- Internal problems = car mechanic.

- External problems = panel beater.

Each is equipped with the right knowledge and expertise to restore your car to its perfect self. A commonality that these 2 services share, however, is the fact that they can present you with unexpected costs that might not be affordable. No matter how reasonable the cost may be, car repairs of any sort are unlikely to be the same as the price of a bottle of milk. And you don’t want to skimp on these kinds of repairs.

But if you have car insurance from an insurer with a reliable reputation for putting their clients’ wellbeing at the front and centre of all that they do, then everything becomes that much easier to budget for. Take King Price, for example. The royal insurer treats all their clients like kings and queens, only uses royally approved service providers, and offers logical car insurance that decreases every month. Which is the best way to prepare for unexpected situations, like needing to have your door panel replaced after a minor argument with a parking lot pole.

Take a few minutes to get a quote online or call 0860 50 50 50 and let King Price help you prepare for the unexpected.

Scratch and Dent Insurance

Will scratch and dent insurance cover panelbeater costs?

Panelbeaters are the chaps you call when your car is looking a bit worse for wear, either from the daily grind or if you’ve had a prang. They’ve got nothing to do with fixing the mechanics of your car, but they will work on your car’s exterior to get it looking brand spanking new. Like it just came back from the factory… And who doesn’t like driving around in a car that looks as good as you feel? It’s even more amazing if you consider that by taking care of your car’s exterior, you’re increasing its resale value. People love buying cars that are free of dents and scratches. Go figure.

The thing is… You might not always have it in your monthly budget to repair scratches, remove dents, or sort out your wonky bumper. Life has gotten expensive and even though you want to smooth out the crinkles, you might not always have the means.

Thankfully, there’s a solution and it can cost you as little as R69 a month so that you can enjoy a scratch-free car without breaking your budget.

Scratch and dent insurance is the solution.

Going to a quality panelbeater won’t cost you a kidney, but it’s still an expense that you have to work into your monthly budget or save for. However, you can find a cost effective way to make sure these costs are handled for you, with scratch and dent insurance.

There are loads of options available on the market, but they all pretty much do the same thing in that they cover the cost of repairing scratches and dents. You’ll just have to check how many different types of damage are actually included. For instance, King Price’s scratch and dent insurance covers little chips, small dents, minor scratches, tar flecks, hail damage, and mag and rim repairs, which is a lot more than other policies.

Let’s talk price.

There are very few of us who can keep our cars in pristine condition for too long without a shopping mall parking pole denting the door, a stone nicking your bonnet, or tar flecks ruining your mags. And you shouldn’t have to wait until you can afford to visit your panelbeater.

The benefit of scratch and dent insurance is that if you can’t afford a couple of thousand, you could find it in the budget for under R100 per month… And then you don’t have to worry about the thousands. What a relief!

Sold on the idea? Before you buy the first policy you find, you need to factor in a few other numbers, including the excess, the limit per claim, and how many claims you can put in per year. King Price, for instance, charges R69 per month and a R250 excess every time you claim. They also set a R3,000 limit (per claim), and there’s an unlimited number of claims you can put in per year.

Those are some pretty impressive figures that you’ll be hard pressed to beat, and we’re experts when it comes to beating things.

A simple solution to delicate work.

You don’t want to skimp on costs when it comes to looking after your car’s exterior. Remember that resale value we spoke about? We’ve even gone over how to find a reputable panelbeater so that you never have to face a terrible (and terribly expensive) experience. In addition to finding the most affordable and trustworthy panelbeater, it’s also worth exploring a scratch and dent insurance that offers you value for money.

Take a few minutes to get a quote online or call 0860 50 50 50 and you’ll see just how affordable it can be to keep your baby looking good.